Overview

The global payment landscape is rapidly evolving, along with consumer behaviours and attention spans. This demands a payment solution that seamlessly integrates into lives, adapts to pace, broadens their opportunities, and drives the transition toward a cashless, thriving economy.

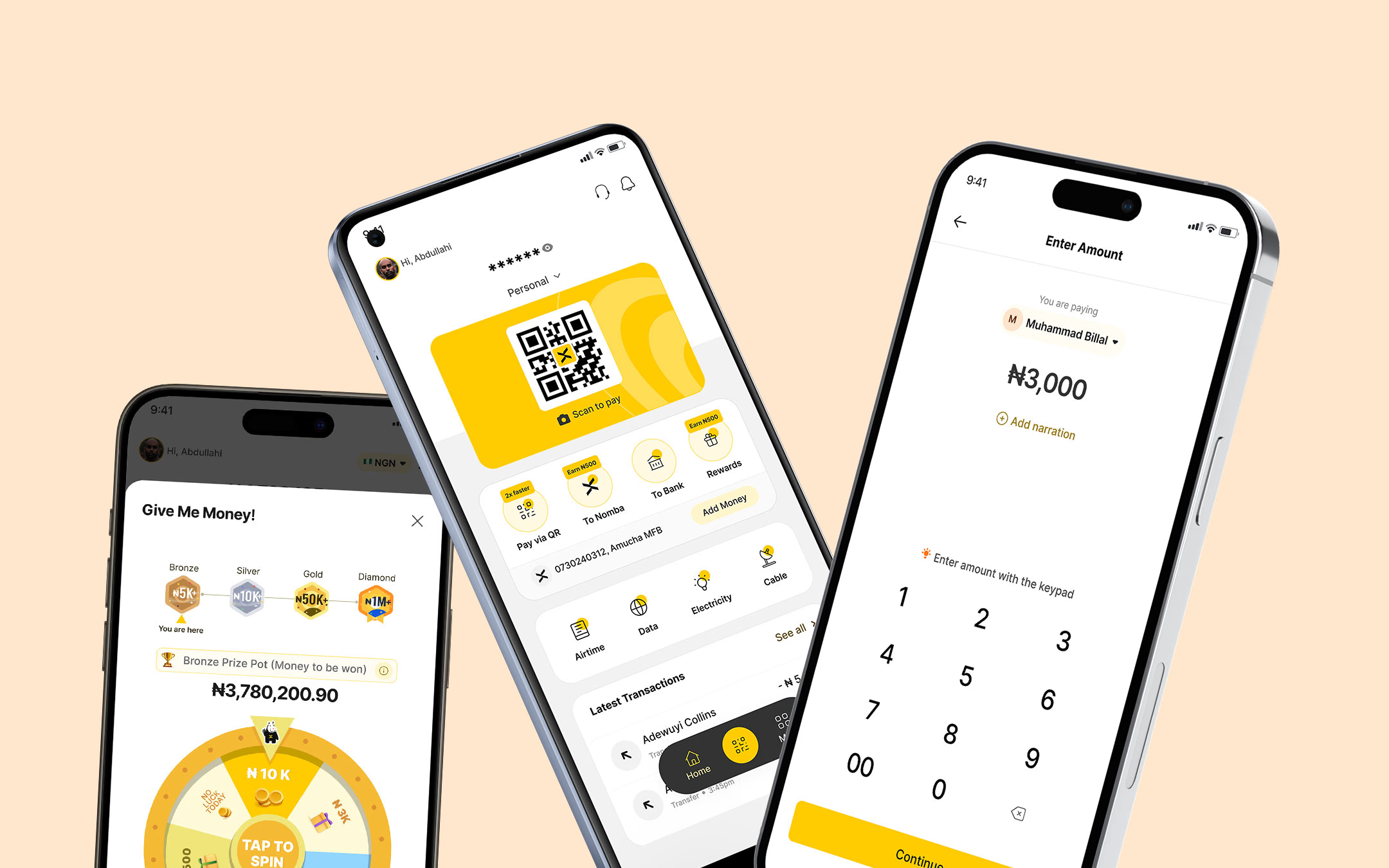

As the head of design, I worked closely with my founders, executives, colleagues, and consumers to design and build payment solutions that's super-fast, engaging, secure, impactful, and increases wealth for our costumers. In 8 months, we were able to grow revenue by 1,204%, conversion rate at 82% (currently), and cutting down onboarding time from 4 minutes to 2.3 minutes, while continually cutting down our CAC.

My contribution

Design & product strategy

User research

Product design

The team

2 × co-founders

1 × product manager

2 × product designer

1 × ux writer/researcher

6 × engineers

Year

2023

Understanding the problem

Before I joined, Nomba's focus was entirely on B2B payments through its web and mobile apps, which had ratings of 2.9 on iOS and 3.8 on Android. At the time, there were no consumer-facing offerings, making this initiative our first venture into consumer banking. Despite the rapid growth of financial technology, over 360 million Africans remain unbanked, coupled with challenges such as transaction delays, poor digital experiences, lack of trust, high transaction costs, and limited accessibility. Nomba seeks to address these gaps, driven by the belief that improving financial inclusion for consumers will ultimately drive greater success for businesses.

Immersion

To fully immerse ourselves, we undertook series of discovery initiatives in three countries: Nigeria, Senegal, and DR Congo. Our goal was to understand the existing payment models, how users transact and conduct business in these regions. Nigeria operates a banking-led payment ecosystem, while Senegal and DR Congo are predominantly mobile-money-led. This diversity highlighted the need for our solution to address these distinct approaches. We engaged with 70 customers (individuals and businesses) through field studies, competitive analyses, qualitative surveys, and research.

Insights from markets

Gathering requirements

At the end of our research, we gathered some important points we would like to solve for our users.

Bringing clarity to the product

We dived into brainstorming and ideation right after, to unravel how and ways we intend to build a product that's scalable, fast, reliable, and delightful, keeping in mind our business and consumer experience goals.

Impactful 0 to 1 Initiatives

Faster payments with Nomba QR

Based on our research, and requirement gathering, my team and I worked closely with engineering, product, a data scientist, and founders to quickly iterate our MVP which was heavily centred around payment via QR. Typically, money transfers take between 60 seconds to 10 minutes for it to get to recipients in these markets, but our solution reduced delivery time to 0.5s, and task completion time to avg. 10s. We iterated a couple of times to find the right fit and balance with consumer experience.

Inclusive banking with Nomba QR Card

"How might we bring the unbanked to become banked?" Insights from our field studies suggest that most unbanked users have feature phones, but then, not all feature phones are unbanked, some are mostly offline due to the high cost of internet data subscription, and cost of smartphones.

We thought about ways to bridge this gap, and our simple solution is the Nomba QR Card - works offline, users can get onboarded with zero cost, users can transfer or withdraw funds from their cards at agent locations around them.

Delighting customers with wealth creation

To increase our DAU, we created an instant money drop feature for our customers called -Give me money. Users that have active balance on Nomba are given interest on their sitting balance, when these users login daily, they are shown a wheel to spin. On spin, they stand a chance to win bigger, small amounts or nothing. the bigger their account balance, the higher their interest, and you are placed in a larger pool. Goal of this design is to increase our DAU (Daily Active Users), and create more liquidity (inflow & savings).

Smart savings, big reward

We thought about ways to further assist our customers expand their horizon and meet their financial goals, and at the same time, increase user acquisition, improve DAU & MAU, and revenue, so we came up with a savings campaign called 'millionaire maker' - a raffle system where savings members are pooled bi-weekly and monthly to win money. To achieve this, I deep dived with my team on how lottery and betting systems work, what are the motivations behind the dopamine attributed to bettings.

Results - Savings value grew by 1,034% in 2 months, savings retention rate at 72%, acquisition grew 15% , DAU grew daily, as old and new users were topping up their savings to entries

Enhancing adoption with merchant locator

To increase our DAU, we created an instant money drop feature for our customers called -Give me money. Users that have active balance on Nomba are given interest on their sitting balance, when these users login daily, they are shown a wheel to spin. On spin, they stand a chance to win bigger, small amounts or nothing. the bigger their account balance, the higher their interest, and you are placed in a larger pool. Goal of this design is to increase our DAU (Daily Active Users), and create more liquidity (inflow & savings).

Summary

Win win

From inception, partly my goal was to design a banking experience, my mum with partial paralysis/ ischemic stroke can use, inclusive design that's accessible by most. Using banking apps has been a major problem for her, since she can only use one arm, plus most banking apps are rather too complex. Seeing her use Nomba, without assistance, is a true testament of impact, and a problem solved, for me.

Desirability is continuous

We have since the added a host of other features to improve our UX and business offerings. Users can pay their utility bills, convert currencies, enjoy savings, schedule transfers, get financial insights on their spend, and more.

With these designs, we've seen improved engagement time, conversion rate, and better task completion rate.

Learnings and iteration

We ran usability tests on our v1 during our early weeks of launch, we discovered a down-spike during onboarding, some users were stuck in their KYC journey. Core reason for exit was that they couldn't access their government verification number. We conducted focus group sessions to ascertain if they'd prefer to be granted access to the app with limited functions (pay with QR) at KYC 0, but then be able to upgrade their KYC while in the app, pretty much reducing the load of our request/ask, and making it progressive. We also utilized this opportunity to enhance our consumer experience from outcome of the usability test performed.

With our new onboarding and upgraded QR payment experience, signup task completion time reduced by 57% (now 2.3mins), conversion rate stood high at 82% in the first 4 months of launch, revenue grew by 1,204%